Pacific Panel Workshops

Takaful Malaysia Panel Workshops

Toll Free : 1 800 88 1138 (Non Life)

MSIG Panel Hospital List

What is No Claim Discount (NCD)?

The No Claim Discount (NCD) is a reward scheme received by motor policy holders for not making a claim during the preceding 12 months.

How much of No Claim Discount (NCD) am I entitled to?

Consumers are eligible for NCD ranging from 0% to 55% of the premium payable depending on the type of vehicle, coverage and number of years claim not intimated. For a private car, the scale of NCD ranges from 0% to 55% as provided in the policy/certificate whereas for motorcycles and commercial vehicles, it ranges from 0% to 25%.

Find out the current insurer for your vehicle, type of coverage, policy period and policy number by entering your details

|

|

|

|

|

| Buy Online E-Hailing Motor Insurance BUY NOW |

|

|

|

| Etiqa Takaful E Hailing Buy Online | MSIG E Hailing Buy Online | Kurnia E Hailing Buy Online |

Please Click HERE for MSIG Malaysia Car Insurance Standard and Basic Coverage and Benefits (English Version)

Please Click HERE for MSIG Malaysia Car Insurance Standard and Basic Coverage and Benefits (English Version)

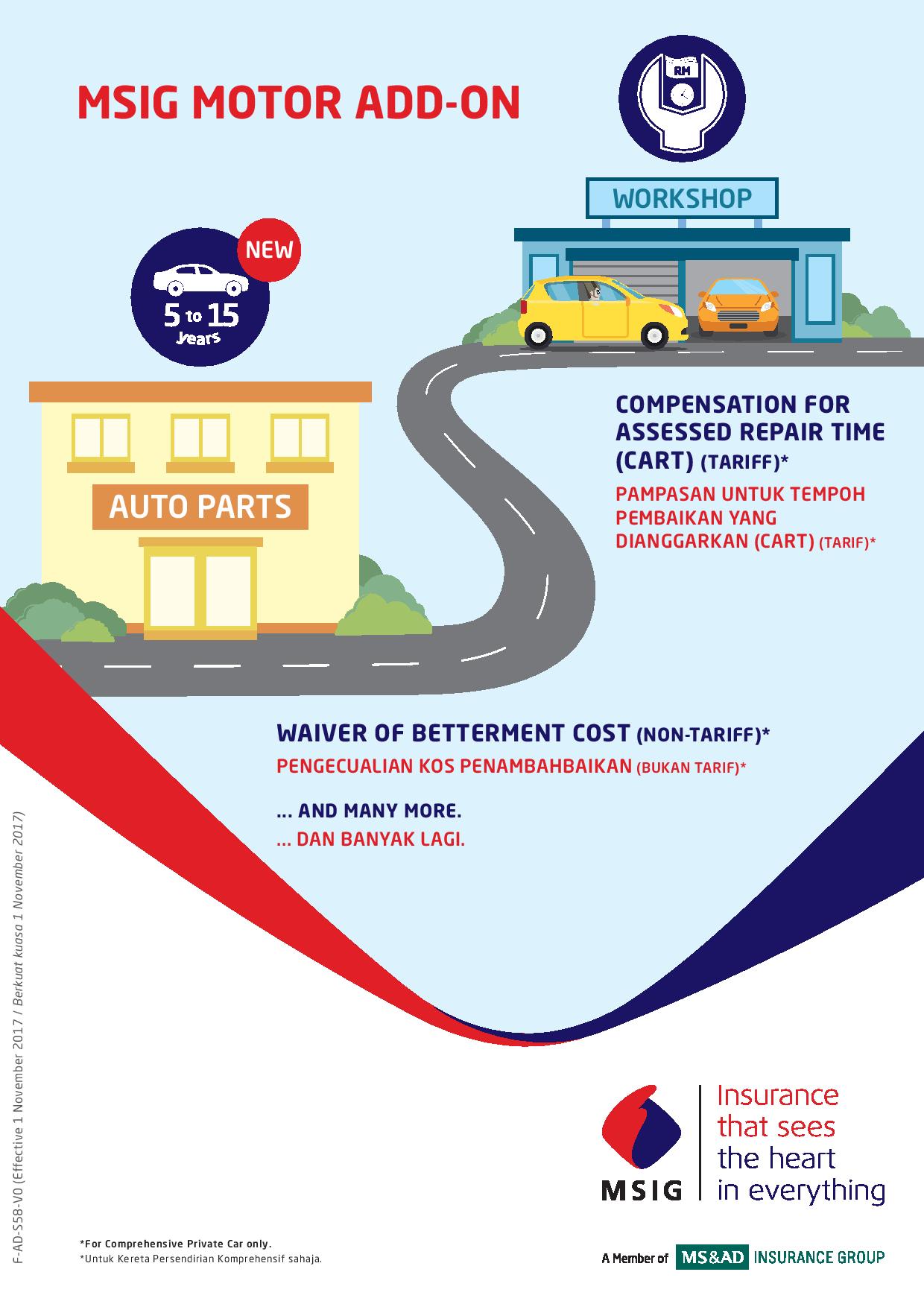

MSIG Motor Add-On Leaflet (Special Perils & Limited Special Perils, Smart Key Shield & Driver's PA Insurance) MSIG Motor Add-On Leaflet 1

MSIG Motor Add-On Leaflet (Waiver of Betterment Cost & Compensation for Assessed Repair Time [CART] MSIG Motor Add-On Leaflet 2

MSIG Motor Add-On Leaflet (Waiver of Compulsory Excess) MSIG Motor Add-On Leaflet 3

MSIG Motor Add-On Leaflet (24-Hour Unlimited Towing Service) MSIG Motor Add On Leaflet 4

Frequently Asked Questions (FAQ)

If your question isn't addressed here, just contact us and we'd be glad to help!

MSIG Malaysia Motor Insurance

Is there any *Motor Assist Program offered by MSIG?

Yes, in the unfortunate event of an accident involving your vehicle or should a breakdown occur, MSIG is at your side to help you. You are entitled to this accident/roadside service assistance without any surcharge to your policy premium.

We have a nationwide network of recommended motor repairers, ready to provide you with prompt, efficient and convenient service, whenever the need arises.

24 Hour Free Assistance Number: 1-300-880-833

*Motor Assist Program is offered to Comprehensive Private Car policyholders.

What is the important point on Insured Value/Sum Insured to be considered when buying motor insurance?

If you are buying a policy against loss/damage to your vehicle, you must ensure that your vehicle is adequately insured as it will affect the amount you can claim in the event of loss /damage.

For a new vehicle, the insured value will be the purchase price while for other vehicles, the insured value is the market value of the vehicle at the point you apply for the insurance policy.

Under-insurance – If you insure your vehicle at a lower sum than its market value, you will be deemed as self-insured for the difference, i.e. in the event of loss/damage, you will only be partially compensated (up to the proportion of insurance) by your insurance company.

Over-insurance – Should you insure your vehicle at a higher sum than its market value, the maximum compensation you will receive is the market value of the vehicle as the policy owner cannot ‘profit’ from a motor insurance claim.

What are the optional add-ons which available for me to extend cover under the Comprehensive Private Car coverage through online?

We would want to recommend you to extend the following optional add-ons:

Smart Key Shield (Non-Tariff)

Windscreen

Legal Liability to Passengers

Legal Liability of Passengers

Strike, Riot and Civil Commotion

Special Perils & Limited Special Perils (Non-Tariff) (Flood, Storm, Landslide, Landslip, Subsidence Cover or Other Convulsions of Nature)

Driver's Personal Accident Cover (Non-Tariff)

Waiver of Betterment Cost (Non-Tariff)

Compensation for Assessed Repair Time (CART)

Please refer to motor add-on leaflet for details of each add-on

You may contact our distribution channel ACPG customer service at 03-92863323 for other add-ons than the above.

How do I enrol for the policy?

You may contact our distribution channel ACPG customer service at 03-92863323 for other add-ons than the above.

How do I enrol for Third Party Cover or Third Party, Fire and Theft Cover?

You may contact our distribution channel ACPG customer service at 03-92863323 for other add-ons than the above.

What are the procedures for me to cancel my policy? What if the Company decides to cancel my policy?

You may cancel the cover at any time by notifying us in writing. Within seven (7) days of the cancellation, you must surrender to us the certificate of insurance or alternatively provide us with a statutory declaration. We may also cancel this cover by giving you 14 days’ notice by registered post to your last known address. Details of the refund of premium are stated in the Policy, Cancellation Condition No. 3.

How do I make a claim?

Please provide a written notice to the Company with full details within seven (7) days upon receiving notice of or sustaining any accident, loss or damage. You may contact any MSIG Branch to obtain a copy of the claim form. Submit the completed claim form to the Company together with all relevant documents as soon as possible.

General Question and Answer

Purchase & Payment

Why is my mailing address not needed when I'm buying insurance?

It's because our entire process is done online – it's faster, easier and also paper-less! Your Certificate of Insurance/Policy will be emailed to you instead.

Can I buy this insurance online with a supplementary credit card?

Yup, you can.

Can I buy insurance from MSIG Online if I don’t own a credit card?

For right now, we’re only accepting debit and credit cards as modes of payment.

Security, Technical & Online Support

Do I need to type in my details again if I'd like to buy again in the future?

Yes, you'll need to - it's for the greater good, really! We don't keep any of your personal details in accordance to the Personal Data Protection Act 2010 and other security reasons.

Help! I made a mistake on my personal info when I was buying insurance.

Don't worry, just email us at enquiry@insuranceonlinepurchase.com.

How do I know that it's safe to buy insurance online? Will my personal info be secured?

Protecting your personal info is very important to us and there are several security features installed to ensure that your data is safe. Check out our Privacy Policy in the Terms of Use to find out more.

How do I make a claim?

You can notify us of your claim right here on MSIG Online under our "Make a Claim” section.

How do I track the status of my claim?

Once a claim has been made, you’ll receive an email acknowledgement. The email lists all the necessary documents needed to support the claim and other details.

How fast can MSIG settle my claim?

Depends on the type of claim, Turnaround for example death/theft claim will be longer than a smaller type of claim. Be assured MSIG is committed to fair and prompt settlement of claims.

If I have an enquiry on this product or any other questions, who should I refer to?

Just email us at enquiry@insuranceonlinepurchase.com with your question and we'll get you an answer!

How do I lodge a complaint if I am unhappy with the product or services?

If you have a complaint about the product or services about us, or you are not satisfied with the rejection or offer for any settlement of a claim, you should first try to resolve the complaint with our Customer Service Centre.

If you are still not satisfied with the decision, you can refer to Bank Negara Malaysia at:

Pengarah

Jabatan LINK & Pejabat Wilayah

Bank Negara Malaysia

P.O. Box 10922

50929 Kuala Lumpur.

Tel: 1-300-88-5465

Fax: 03-2174 1515

Email: bnmtelelink@bnm.gov.my

Or, you may also write to the Ombudsman for Financial Services (OFS).

Disclaimer for FAQ

The FAQs compiled herein are merely informational and not intended to be construed as a contract of insurance. While every effort has been made to ensure that the information contained herein is accurate and up to date, this is not always possible. Please refer to actual policy for exact terms and conditions of the insurance product that you are purchasing.

About MSIG

MSIG Malaysia is one of the largest general insurers in the nation! We have a network of 20 branches in various locations across Malaysia, ensuring that we're close by whenever you need us.

A subsidiary of Mitsui Sumitomo Insurance Company, Limited and a member of MS&AD Insurance Group Holdings, Inc., MSIG Insurance (Malaysia) Bhd has a strong financial backing combined with global expertise and local knowledge. Our multi-channel distribution network has established strong partnerships with agents, brokers or motor franchises, local and Japanese direct corporate clients, as well as partnership programmes with financial institutions.

As a customer, you can expect financial stability, top quality innovative insurance products and related services, and a strong commitment to service. We aim to serve our customers, stakeholders and society by adhering to our Values:

Customer Focused

We continuously strive to provide security and achieve customer satisfaction.

Integrity

We are sincere, kind, fair and just in our dealings with everyone.

Teamwork

We achieve mutual growth by respecting one another's individuality and opinions, and by sharing knowledge and ideas.

Innovation

We listen to our stakeholders and continuously seek ways to improve our work and business.

Professionalism

We make sustained efforts to improve our skills and proficiency so that we can provide high quality services.

Good news for existing Kurnia Insurance policyholders, you do not have to wait for next renewal, its prorated chargeable.

** No vehicle inspection required!

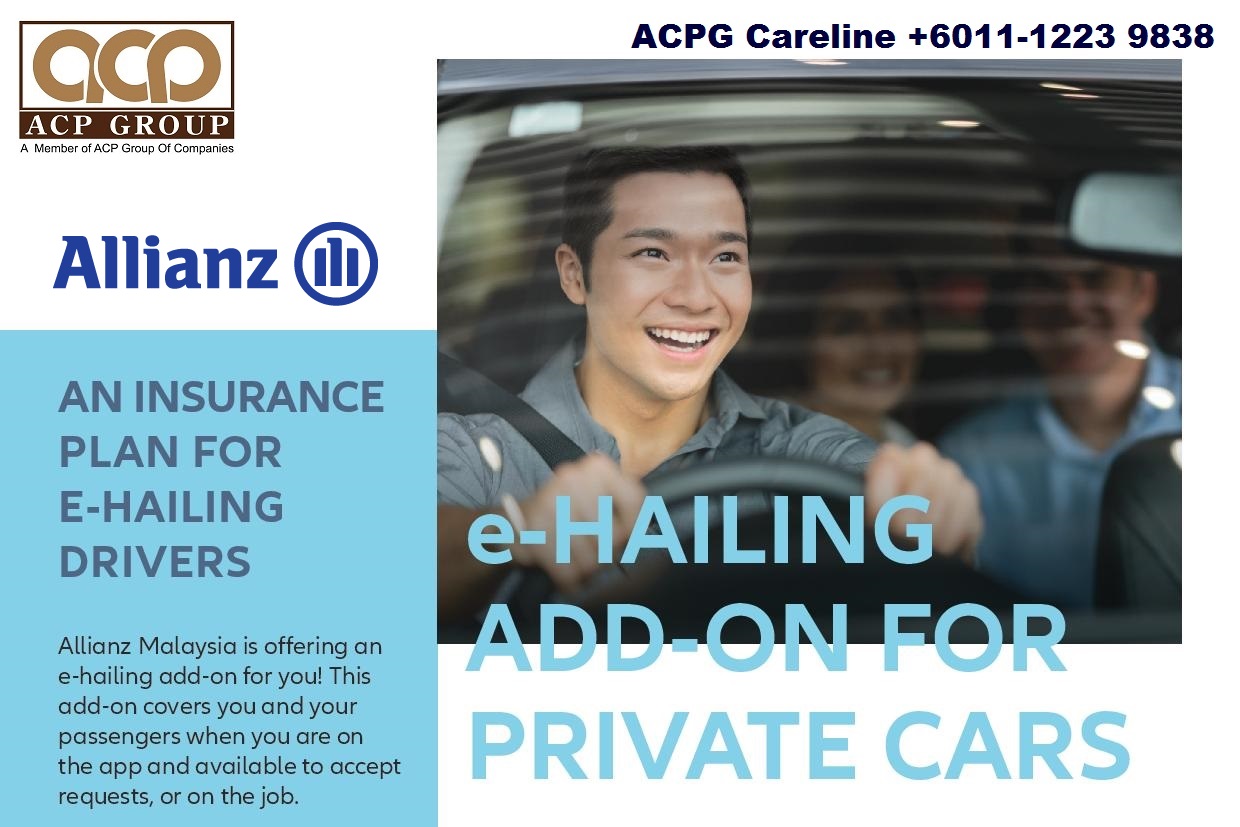

What does Kurnia package into this E-Hailing (GRAB) Insurance bundle?

Loss / own damage

Liabilities to third parties

Legal Liability to Fare-Paying Passengers for Negligent Acts

Personal Accident Cover for Authorised E-Hailing Driver

Mid Term Inclusion is allowed, Prorated premium chargeable. No vehicle inspection is required

Eligibilities:

Insured age: must be 21 y/o and above

Vehicle age: 0 to 7 y/o

Arranged By

ACPG Managment Sdn Bhd

03-92863323

Click here for Whatsapp Enquiry

wasap.my/+601112239838/AXAEhailingmotorinsurance

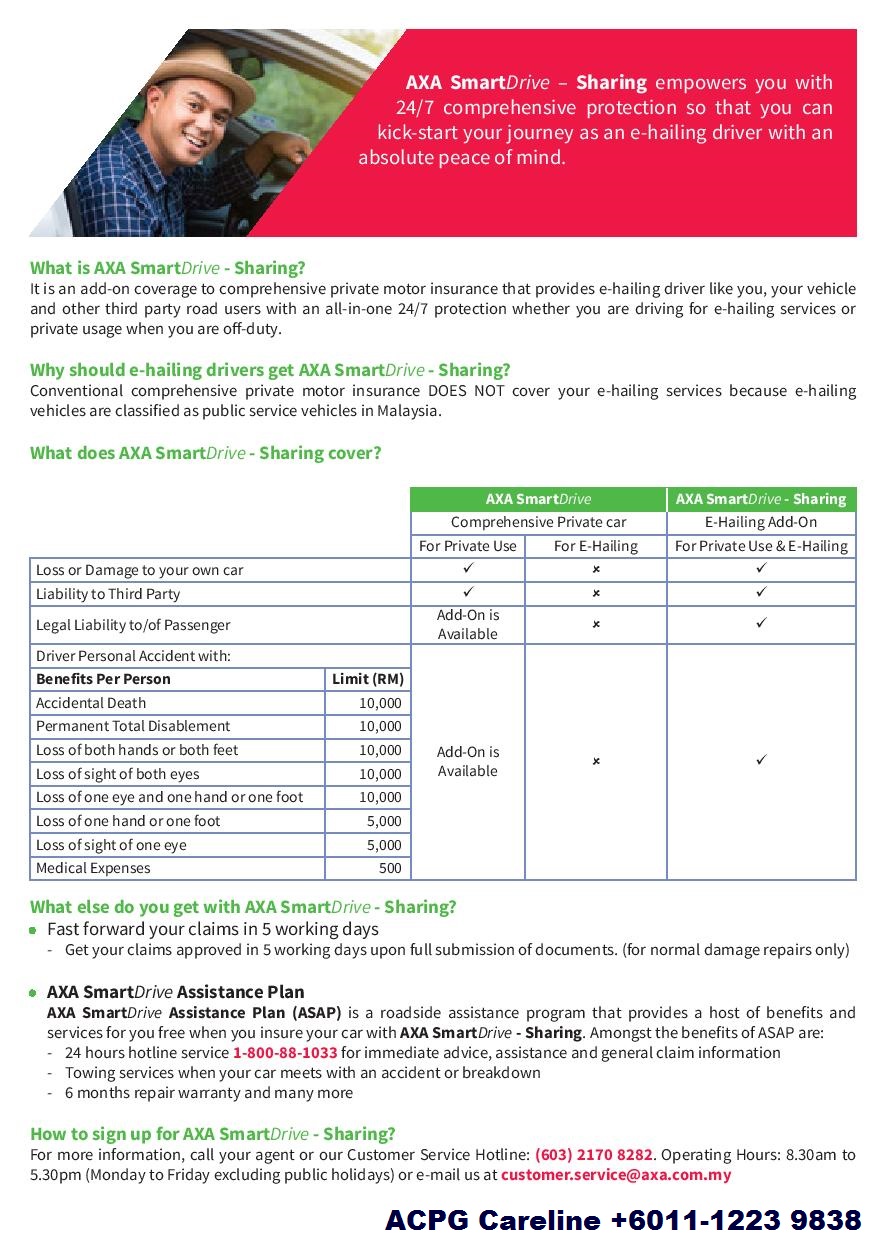

24/7 on the road protection for e-hailing and private usage

Kick-start your journey as an e-hailing driver with 24/7 comprehensive protection and absolute peace of mind

SmartDrive - Sharing

Did you know? Conventional comprehensive private motor insurance DOES NOT cover your e-hailing services because e-hailing vehicles are classified as public service vehicles in Malaysia.

SmartDrive – Sharing is an add-on to comprehensive private motor insurance that provides e-hailing driver like you, your vehicle and other third party road users with an all-in-one 24/7 protection whether you are driving for e-hailing services or private usage when you are off-duty.

Key benefits explained

24/7 protection for both e-hailing services and private usage

- Loss or Damage to your own car

- Liability to Third Party

- Legal Liability to/of Passenger

- Driver Personal Accident cover with up to RM10,000 pay-out for death, bodily injury, or disablement caused by road accidents

Fast forward your claims in 4 working days

- Claims below RM5,000 approved in 4 working days* upon full submission of documents

- Claims RM5,000 & above approved in 6 working days* upon full submission of documents

*Excluding claims under further investigation and claims with severe vehicle damage

24/7 emergency road assistance

24 hour hotline service for car breakdown and towing services

Repair warranty

6-month warranty for all repairs by our Panel Repairer

Extend your coverage

Options to include coverage for flood, landslide, or damage from riots

Optional windscreen cover

Panel of over 200 windscreen workshops, with easy claims and no impact on your NCD

Insurans Perlindungan Kenderaan E-Hailing

Berita menarik. Insurans e-hailing www.insuranceonlinepurchase.com.

Penambahan insurans e-hailing diwajibkan bermula 12 Julai 2019. Oleh yang demikian, mari kita tinjau, insurans manakah yang telah menawarkan pakej nilai tambahan bagi pemandu e-hailing seperti ACPG.

Permohonan boleh dibuat melalui;

Datang ke Ibu Pejabat ACPG

E-Mail (support@acpgconsultant.com)

Panggilan (+603-92863323)

WhatsApp (+6011-12239838)

Selain itu, lebih 12 insurans yang menawarkan pakej e-hailing private hire addons.

1. Cover note saya akan mati sebelum Julai 2019. Bagaimanakah masib saya?

Hidupkan cover note baharu, barulah tambah add-ons e-hailing. Sebab tarikh kuat kuasa ialah 12 Julai 2019.

2. Saya baru sahaja hidupkan cover note pada bulan Mac 2019. Dan insurans saya belum tawarkan lagi tambah nilai -hailing.

Sabar, masih ada masa lagi.

3. Berapakah bayaran add-ons ini?

Sekitar RM150 hingga RM400 atau antara 40 sen sehari hingga RM1.20 sehari

4. Adakah add-ons e-hailing datang dengan pakej cermin kereta?

Biasanya tidak. Ia berasingan

5. Apakah perlindungan yang ditawarkan?

Melindungi penumpang berbayar tambang, pemandu dan kenderaan sekaligus. Ia juga melindungi akibat kecuaian penumpang atau kerosakan yang disebabkan oleh penumpang.

6. Kenapakah ianya wajib?

Kerana tiada satu pun insurans di Malaysia yang melindungi penumpang YANG MEMBAYAR TAMBANG melainkan insuran teksi sahaja.

7. Bukankah kompeni hijau mendakwa, mereka ada insurans ini?

Palsu. Bahkan banyak kes, mereka berdiam diri. Jika ada pun, sumbangan ihsan dan sumbangan tabung derma dari pemandu.

8. Saya sudah ada SOCSO

Perkeso adalah tanggungjawab dan kesedaran individu yang melakukan tugasan berisiko. Kelebihan Perkeso, anda boleh mendapat tuntutannya walaupun insurans e-hailing telah membayar pampasan. Dua dalam satu! Anda mungkin ingin tahu, cara caruman perkeso. Klik ➡️DI SINI⬅️

9. Jika insurans saya masih tidak menawarkan pakej ini sehingga Julai 2019?

Batalkan insurans terdahulu melalui ejen. Kemudian pilih salah satu dari 11 insurans di atas. Ingat, langgan sekali pakej e-hailing.

Sijil nombor Indeks: M.X. 22

Item 5

ORANG-ORANG ATAU KELAS ORANG YANG LAYAK MEMANDU

1. Penggunaan biasa

(a) Pemegang Polisi

(6) Mana-mana orang lain yang dibenarkan memandu oleh tuan empunya pemegang polisi tersebut.

2. Pemandu E-Panggilan

Mana-mana Pemandu Sewa Persendirian yang dibenarkan oleh pemegang polisi di mana beliau mestilah wajib mempunyai lesen PSV dan disahkan sebagai pemandu e-panggilan yang berdaftar.

Dengan syaratnya, bahawa orang yang memandu telah dilesenkan mengikut

pelesenan atau undang-undang atau peraturan lain untuk memandu kereta dan tidak dibatalkan kelayakan oleh perintah Mahkamah undang-undang oleh apa-apa enakmen atau peraturan dalam hal itu.

Item 6

BATASAN UNTUK MENGGUNAKAN

1. Penggunaan biasa

Hanya untuk tujuan sosial, domestik dan keseronokan dan untuk hal peribadi pemegang polisi

2. Pemandu E-Panggilan

Untuk mengangkut penumpang yang membayar tambang (yang ditakrifkan oleh

Pihak Berkuasa) oleh mana-mana orang yang telah dilesenkan oleh Pihak Berkuasa dan didaftarkan oleh pengendali perkhidmatan untuk memikul tugasan itu, dan yang juga mempunyai kebenaran pemegang polisi untuk berbuat demikian.

Polisi ini tidak melindungi upah sewa tambang selain daripada yang telah dibenarkan oleh Agensi Pengangkutan Awam Darat (APAD) dan Lembaga Perlesenan Kenderaan Perdagangan( CVLB ) yang berkuasa Malaysia Timur dan juga tidak sah jika kenderaan itu digunakan selain dari yang tersebut iaitu tujuan perlumbaan dan pengangkut barang, bungkusan dan seumpamanya

Disemak pada 5 July 2019

|

|

|

|

|

|

|

|

|

|